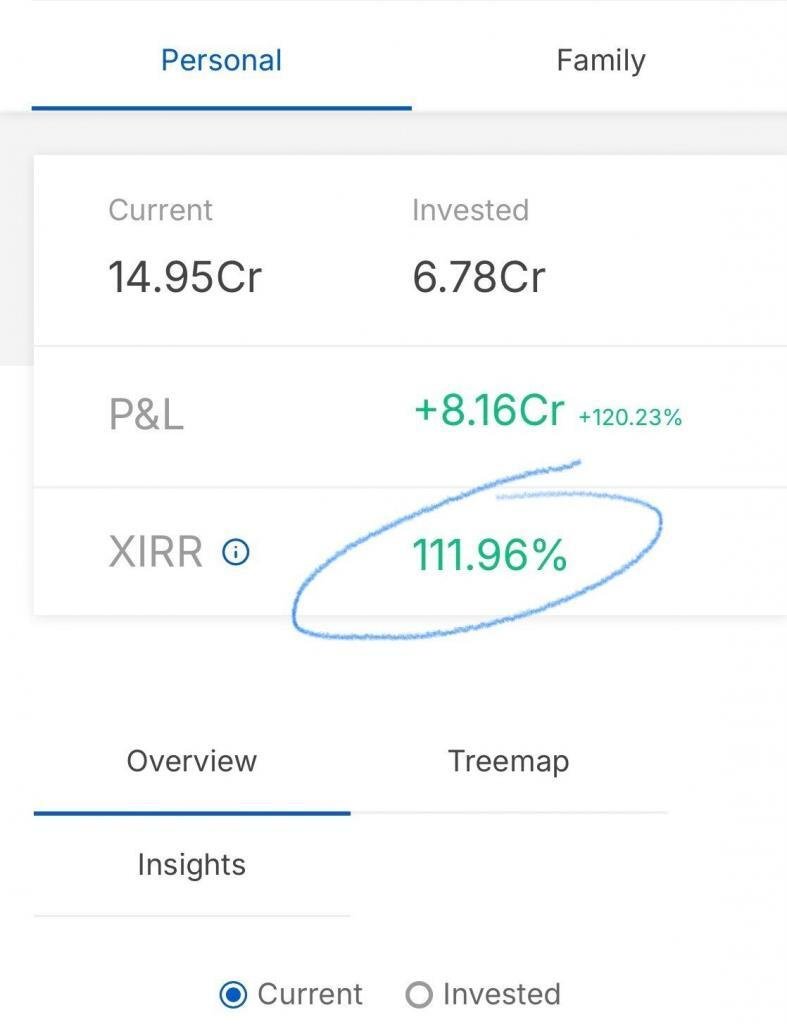

Friends, On this auspicious day of Diwali, let’s discuss XIRR (Extended annualised rate of return)… This is updated formula of CAGR because it takes into account multiple investments at different points of time… Zerodha has this useful feature readily available at their Console (Console > Portfolio > Holding > View XIRR)… It is said that 15-20% XIRR (CAGR) is very good in Equity Markets… Nifty gave 14% CAGR in last 2 years…My Portfolio XIRR (CAGR) has been 112% in last 2-3 years … See attached Screenshot of my Portfolio XIRR (CAGR) … Friends, there are 15 crore demat accounts in India, then there are highly powerful and resourceful FIIs & DIIs & Mutual Funds… So every investor is competing with all above crores of investors in Stock market to make money… Even if you outperform Nifty or Sensex by 2-3% consistently, you are beating all the above 15 crores of individual investors, FIIs and DIIs and Mutual Funds (that is why making money consistently in Stock market is so difficult)… And my portfolio did beat these Crores of informed investors, FIIs, DIIs, Mutual Funds by 98% CAGR every year (112% – 14%) in last 2-3 years.. Happy Investing and Happy Diwali ![]()