As a long term investor, you need to be very clear about why you are investing in the Indian equity markets. If the logic is clear, one will normally stick with their investment plan and not get perturbed by market conditions.

In addition, if the reasoning is simple and clear, it is even easier to stick with your plan.

Most large investors, especially foreign investors, have a simple reasoning to invest in India.

Reasoning:

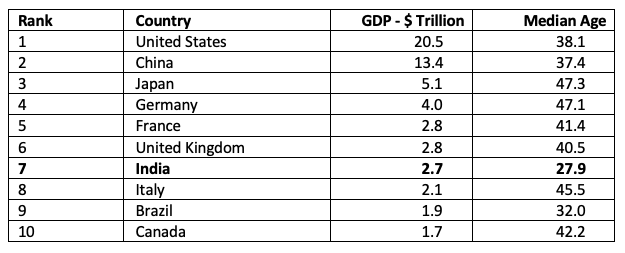

1. India’s GDP is currently about $ 2.7 trillion (this figure may change a bit based on USD / INR rates). Over the long term, nominal GDP will keep growing, at a rate close to 10% pa.

2. One of the main reasons for the growth is that, the Median age of the population in India is close to 28 years, which is significantly lower than all other large economies.

A younger population means, there are more people out there who are up-skilling themselves, want to earn more, and spend more. The average Indian is yet to buy a car, yet to buy a house, is probably considering a marriage and sending his or her kids to college is a choice which is not even on the radar.

A younger population means, there are more people out there who are up-skilling themselves, want to earn more, and spend more. The average Indian is yet to buy a car, yet to buy a house, is probably considering a marriage and sending his or her kids to college is a choice which is not even on the radar.

Compare this with other countries, where the population is starting to age rapidly and the proportion of people contributing to the economy is starting to reduce as more people retire.

As ‘Young India’ progresses on his / her life journey, they will earn more and consume more. As they consume more, the companies addressing their needs will keep growing.

As an investor, chances of going wrong by investing in a collection of good companies is quite remote. There will be periods where stock markets will be volatile, for various reasons. But in the long term, as long as the Indian economy grows (which, with a young population, it will), stock markets returns will be better than other asset classes.